Welcome to The Silent Shopper, the newsletter for retail operators, retail investors, and of course, shoppers. Thank you for joining me for Edition 1.

Today, I will be sharing my outlook on the US retail industry and spotlighting three trends that will continue to differentiate retailers who win: (1) Value orientation, (2) Personalization, and (3) Technology.

1. Value Orientation From Retailer to Brand to Product

Consumers are agitated by spending more and receiving less, and macroeconomic woes (e.g., inflation, tariffs, limited real wage growth) create an uninspiring environment to spend more dollars. Consumers are shifting towards (a) retailers with the lowest cost to serve and (b) brands and products that provide greater value per dollar, including private label or dupe products.

Visits to Aldi are up 7.1% YoY, compared to the broader grocery segment’s meager increase of just 1.8%. This is even more impressive when we consider that 2024 visit growth was 18.2% YoY. The fastest-growing grocer in the US will open a record 225 stores this year and promises to save shoppers an average of 36% on an average shopping trip. There is similar strength and shopper infatuation at other value-oriented retailers, like TJ Maxx, whose comparable store sales rose 4% YoY (2023-2024), and Ross at 3% YoY. As a comparison, Target CSS increased just 0.1% in the same time period.

In a video that could be mistaken as the CEO of McDonald’s holding an adult toy on his personal LinkedIn page, Chris Kempczinski teased the reintroduction of the Snack Wrap. While commentary has been mixed, Wall Street agrees that this $2.99 treat is a buy. Goldman Sachs upgraded MCD from neutral to buy, explicitly citing the snack wrap as an example of MCD’s commitment to market share gains and product innovation. The stock has been on an upward trajectory since the announcement on July 10 (+2.5% one month later, albeit buoyed by strong 2Q25 results), and foot traffic has seen double-digit jumps relative to last year. It reminds me a lot of Starbucks’ Pairing Menu, which offered a coffee and croissant for $5 and was one of Laxman Narasimhan's last initiatives. For reference, a Snack Wrap and large soda in NYC comes out to $4.98.

2. Increasingly Personalized and Experiential Shopping

With customers having more options than ever to buy the same products, meaningful and tailored experiences, in-store or online, can help the customer feel seen by the retailer, rather than dismissed as a member of a money-making group. 80% of shopping continues to happen in store, and retail executives anticipate that consumers will continue to prefer spending on experiences over goods, leverage genAI and social media for shopping, and go on more frequent trips with smaller tickets.

One example of a retailer that has leaned into this personalization trend nicely is Uniqlo, who has introduced UTme! custom tote bag and t-shirt printing services at eleven US stores. Uniqlo offers five products and allows customers to add custom stickers, typography, paint, and images to their merchandise, creating a one-of-a-kind, sentimental product for the customer in an engaging experience that keeps them lingering in the store for longer. Uniqlo has also rolled out cafes and fresh flowers in select stores to further communicate in-store shopping as an experience.

In the ongoing battle between Fasting Retailing and Inditex, it is worth noting that Zara has offered some kind of personalized handbag since 2020. How is this different? Zara’s scope of customization is small (one letter and one color), customization services are online-only (no customer experience), and merchandise available for customization is limited to $50-100 faux leather handbags. While a custom Uniqlo canvas tote reinforces the brand’s promise of high quality basics, I feel Zara’s is a bit off- if the intention is for customers to buy with trends (and offer quality that matches the trend’s duration), why would a shopper make the additional investment of customizing it?

Additionally, loyalty programs are increasingly important levers to (a) fuel personalization, (b) tier / segment customers, and (c) unlock cobranding opportunities. In keeping with Trend 1, Walmart attracted and retained many well-resourced customers during the pandemic. Today, the American Express Platinum Card offers a complementary Walmart+ membership (which is particularly funny because AmEx was the exclusive credit card accepted at Costco from 1999-2016). Non-Walmart Walmart+ perks now extend to Paramount+ streaming, free Burger King Whoppers, gas discounts, and Pawp (pet care).

3. Embracing Technology to Strengthen Store Operations and the Customer Experience

Phones have largely taken the place of a Sales Associate who would previously accompany the customer across the in-store journey, from welcome to payment and reengagement. In beauty, for example, products used to be stored behind a counter. The Sales Associate would welcome the customer to the retailer / brand counter and selectively showcase products they believe the customer will enjoy or otherwise are incentivized to sell. Walking around a Sephora today, in contrast, almost every shopper has their phone in hand, cross-referencing reviews of similar products, checking out social media recommendations, and identifying promotional opportunities on their own. They are using their phones to serve themselves.

This transformation can also be seen in store operations to ensure that the products customers seek to interact with are stocked at the right service levels and times. Professionals who once manually sorted out inventory scheduling, personnel staffing, merchandising decisions, and loss prevention now review automated strategies generated from customer insights.

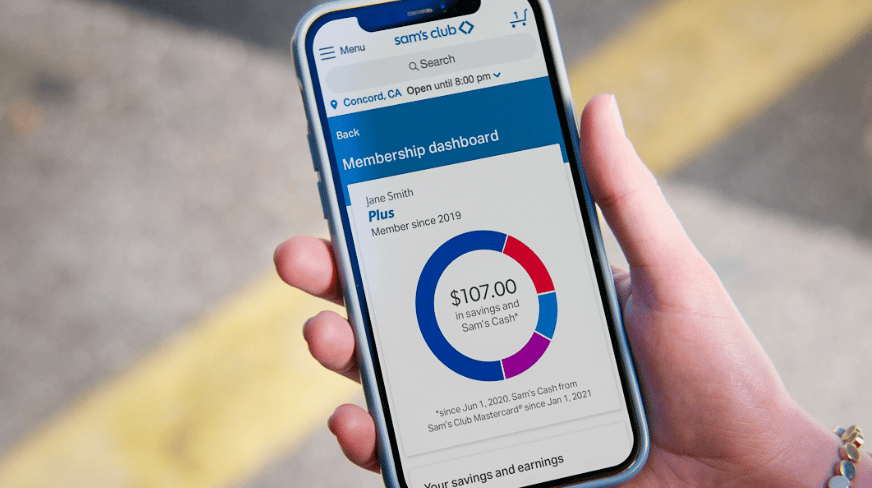

In keeping with the Walmart motif, I would like to spotlight Sam’s Club as a strong example of robust internal and external technology. Sam’s Club has 69M US members, just behind Costco’s 73M members (and far behind Amazon Prime’s 166M members). However, the Sam’s Club app (4.9/5.0 rating) has 4.3M reviews in the Apple App Store, whereas Costco (same rating) lags at just 1.0M. This divergence is the same on the Google Play Store.

While I agree that Costco is the superior warehouse club, the Sam’s Club digital capabilities rival those of best-in-class Sephora and Starbucks. The app is now a necessity for all members. It serves as proof of membership when you enter and is how you pay at the register (or Scan & Go, which makes up 35% of sales, a metric that grows at 6% per year) and gas pump. The app instantly analyzes your most-purchased items and purchasing cadence, sending emails and push notifications if you missed your weekly shopping trip with a proposed cart based on what it anticipates you will buy. This year, Sam’s Club also rolled back all use of texting / emails aside from DFA and promotions. To check in for pickup, for example, there is now a button in the app. Given the demographic of the typical Sam’s Club shopper (e.g., busy suburban family with kids / pets), I think they have aligned their digital efforts nicely to what drives convenience for their customer.

Sam’s Club also introduced their Membership Dashboard, which among other things, shows the customer how they have saved from Instant Savings (weekly promo), Sam’s Cash, free shipping, and Everyday Club Savings (a rough approximate of how much additional you would have spent). It is easy for a customer to see this graphic, recognize the amount saved exceeds their membership cost, and happily renew.

Digital and CX is an area where Sam’s Club (and parent Walmart) are doubling down, which was largely the focus of Todd Sears’ talk with Evercore ISI in June. He shared an interesting statistic that now that all 600 clubs offer pizza delivery, the average order value of a pizza order is 10x the price of the pizza. He also noted that once shoppers experiment with these digital tools (e.g., Scan & Go, app ordering), they do not go back, further justifying their investment.

This emphasis extends to Walmart’s partners, offering an attractive B2B opportunity. At the end of June, Sam’s launched its Member Access Platform (MAP), a tool that uses membership data (e.g., from emails, ads, Scan & Go, purchasing history, browsing history) to give advertisers precise measurements of how their retail campaigns drove sales and brand loyalty.

(Not So) Honorable Mention: Buy Now and Pay Later (BNPL)

I will remain quite surface level with this topic, so that you know (a) the BNPL acronym and (b) to stay far away when you hear it. Here is a helpful graphic if you are not familiar with how it works:

Even if retailers cannot raise prices in direct response to BNPL, I anticipate the impending need for Klarna, Affirm, etc to absorb more losses will raise prices across retailers who use this service.

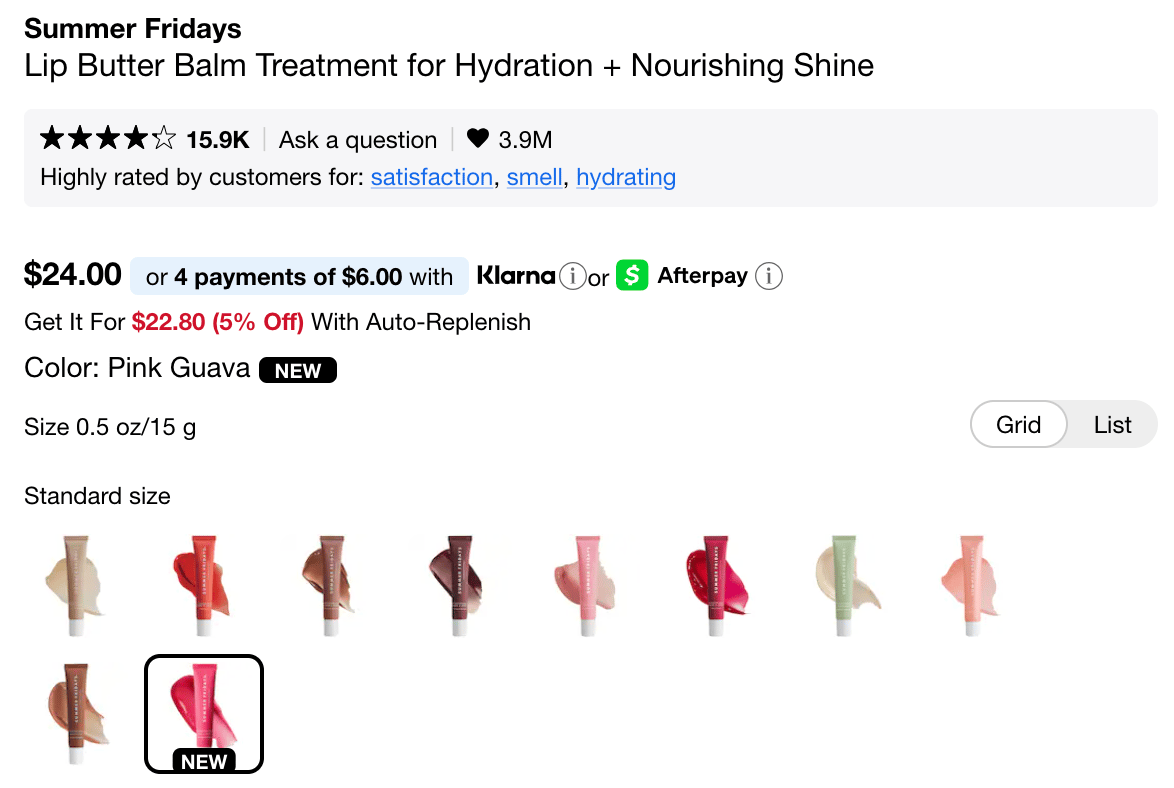

Of all the retailers I frequent, Sephora is the biggest BNPL offender. In addition to all prices also being displayed in their BNPL form online, their incessant BNPL advertising (e.g., at the credit card terminal in stores, promotions EXCLUSIVE to those using BNPL) is repulsive (and highly focused on young consumers, see their BNPL picks below). If you have fallen into this trap, please reevaluate the need to finance mascara.

A Product / Service I Have Been Loving

To close this edition, a product / service I have been loving is azelaic acid. I received a prescription from my dermatologist after discussing some skin texture and redness issues that flared with the summer heat. Between my azelaic acid and tretinoin prescriptions, I am spending the least time and money I ever have on my skin (each product costs ~$10, lasts ~three months, and is the only serum I use), and it has never looked better. I am obviously not recommending a prescription, but this serves as a powerful reminder that while you may be able to put in 10x more effort, a different approach may work 10x better.

Thanks so much for reading, and I hope you will join me next time.

Best Wishes,

TSS